Introduction: Starting a new business requires a great idea, determination, and, of course, financial resources. Funding is often a major hurdle for aspiring entrepreneurs, but with the right approach, you can attract investors and secure the capital needed to bring your startup to life. In this blog post, we will explore effective strategies and best practices for raising funds for your startup business.

- Define Your Funding Needs: Before approaching investors, it’s crucial to determine the amount of funding required for your startup. Create a detailed business plan outlining your goals, expenses, and revenue projections. This will help you determine how much capital you need to get your business off the ground and sustain its growth in the initial stages.

- Bootstrap: Bootstrapping involves funding your startup using your own savings or personal resources. While this approach may not provide substantial capital, it demonstrates your commitment and dedication to your business idea. Bootstrap as much as possible to show potential investors that you have a personal stake in the venture.

- Friends and Family: Approaching friends and family for financial support is a common way to raise startup funds. However, it’s crucial to treat these investments as you would any other. Create clear terms and agreements, establish legal documentation, and communicate the potential risks involved. Remember to maintain professionalism and transparency throughout the process.

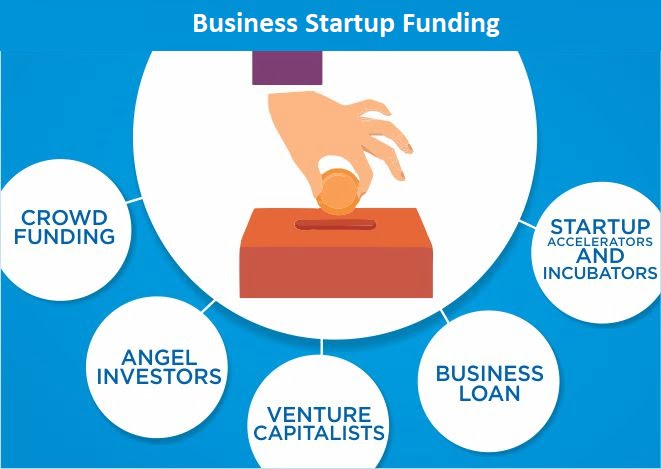

- Angel Investors: Angel investors are individuals who provide financial backing to startups in exchange for equity or convertible debt. These investors are often experienced entrepreneurs themselves and can provide valuable guidance and mentorship in addition to funding. Research angel investor networks, attend startup events, and network with professionals in your industry to find potential investors.

- Venture Capitalists (VCs): Venture capitalists are institutional investors who provide funding to startups in exchange for equity. They typically invest in companies with high growth potential. When approaching VCs, make sure your business plan demonstrates scalability, market potential, and a clear exit strategy. Prepare a compelling pitch deck and be prepared for thorough due diligence.

- Crowdfunding: Crowdfunding platforms, such as Kickstarter or Indiegogo, have gained popularity as a means of raising funds for startups. Create a compelling campaign that clearly communicates your business idea, value proposition, and potential impact. Offer attractive rewards to backers and leverage your network and social media to maximize exposure.

- Grants and Competitions: Explore grants and startup competitions that offer financial support and resources to early-stage businesses. Many governments, organizations, and private institutions provide grants specifically designed for startups in certain industries or regions. Participating in competitions not only offers the chance to win funding but also provides exposure to potential investors and valuable networking opportunities.

- Accelerators and Incubators: Joining an accelerator or incubator program can provide access to funding, mentorship, and resources. These programs are designed to help startups grow and succeed. Research and apply to reputable programs that align with your business goals and industry.

Conclusion: Raising funds for a startup can be a challenging process, but with a well-defined plan and the right approach, you can secure the necessary capital to turn your vision into reality. Remember to clearly communicate your business idea, demonstrate market potential, and maintain professionalism throughout the fundraising journey. By exploring various funding options and leveraging your network, you increase your chances of attracting investors and setting your startup on the path to success.